is there real estate tax in florida

If they owned property in another state that state might have a. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

5 Great Florida Property Tax Appeals Numbers And Dates South Florida Law Pllc

Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

. For example the Save Our Homes assessment limitation caps increases in assessments for property taxes. Further for all other types of transfers in Miami-Dade. Property taxes apply to.

Homestead exemption which is available on your primary residence reduces your assessed property. Its called the 2 out of 5 year rule. There are some laws that limit the taxes due on owner-occupied homes in Florida.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences. Information regarding these and additional taxes.

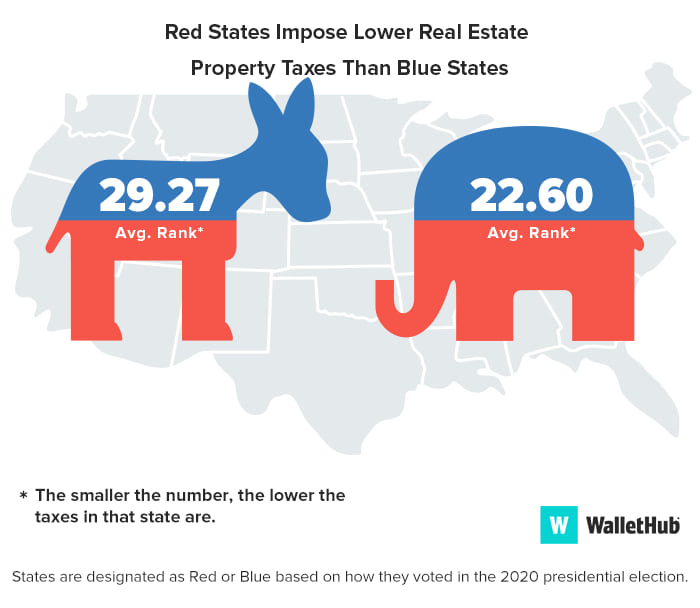

Since floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after january 1 2005. What is the Florida property tax or real estate tax. Florida real property tax rates are implemented in millage.

Florida Taxes A Quick Look. There is no state income estate or gift tax in Florida. History of the Florida Estate Tax.

Floridas general state sales tax rate is 6 with the following exceptions. Available to all residents and amounting to a maximum of 50000 off the assessed value of the property. The state abolished its estate tax in 2004.

Counties in Florida collect an average of 097 of a propertys assesed fair. Businesses also have to pay a tangible personal property tax if they own 25000 or more in business assets other than real estate and certain vehicles. Florida property owners have to pay property taxes each year based on the value of their property.

It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. Currently there is no estate tax in Florida. TOP 6 Florida Tax Facts.

In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st. Major taxes collected in Florida include sales and use tax intangible tax and corporate income taxes. Heres an example of how much capital gains tax you might.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Prior to the change in 2004 federal law allowed a.

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Florida Real Estate How Much Will It Cost Nmb Florida Realty

Are There Any States With No Property Tax In 2022 Free Investor Guide

What Is Florida County Tangible Personal Property Tax

Estate Tax How Does It Affect Me Florida Estate Planning Florida Probate Florida Real Estate Florida Bankruptcy And Tax Attorneys

Taxes And Titles The Name On Your Property Title Matters

Florida Real Estate Taxes What You Need To Know

Florida Property Tax Calculator Smartasset

Florida Real Estate Taxes And Their Implications

What Is A Florida County Real Property Trim Notice

Homestead Exemption An Awesome Property Tax Break For Florida Homeowners Verobeach Com

Property Values Are Up So What About Taxes Florida Realtors

The Ultimate Guide To Florida Real Estate Taxes

2022 Real Estate Tax Conference Tax Section Of The Florida Bar